| Loading ITables v2.4.4 from the internet... (need help?) |

In this post, I explore the distribution of mutual funds and their holdings based on Morningstar’s datasets.

The analysis of mutual funds helps understand the behavior of active investors in capital markets, which is playing a key role in market efficiency and asset pricing. Before digging into model analysis, it is important to first have a big picture of their data distribution.

I. MorningStar

Morningstar has comprehensive and granular mutual funds holding information, including stocks, bonds, loans, derivatives, cash and other funds. This database can be accessed via Morningstar Direct using Excel or Python. However, it has daily download limits, which requires users to subscribe extra service. It is possible to download the whole databases within 20 years without extra subscription :)

Also, it is worth noticing that some open souce tools, like mstarpy, can help fetch data from Morningstar website for free, which includes stocks’ price, funds’ performance and so on.

II. Preview

According to information provided by Morningstar Direct, there have been historically 331,112 mutual funds (after dropping observations with duplicated securityID) from global 78 areas so far, and they are managed by around 26,086 teams of managers.

The table below shows the distribution of funds by area. It can be observed that (LUX)(Luxembourg) is the area with the highest number of registered open-funds.

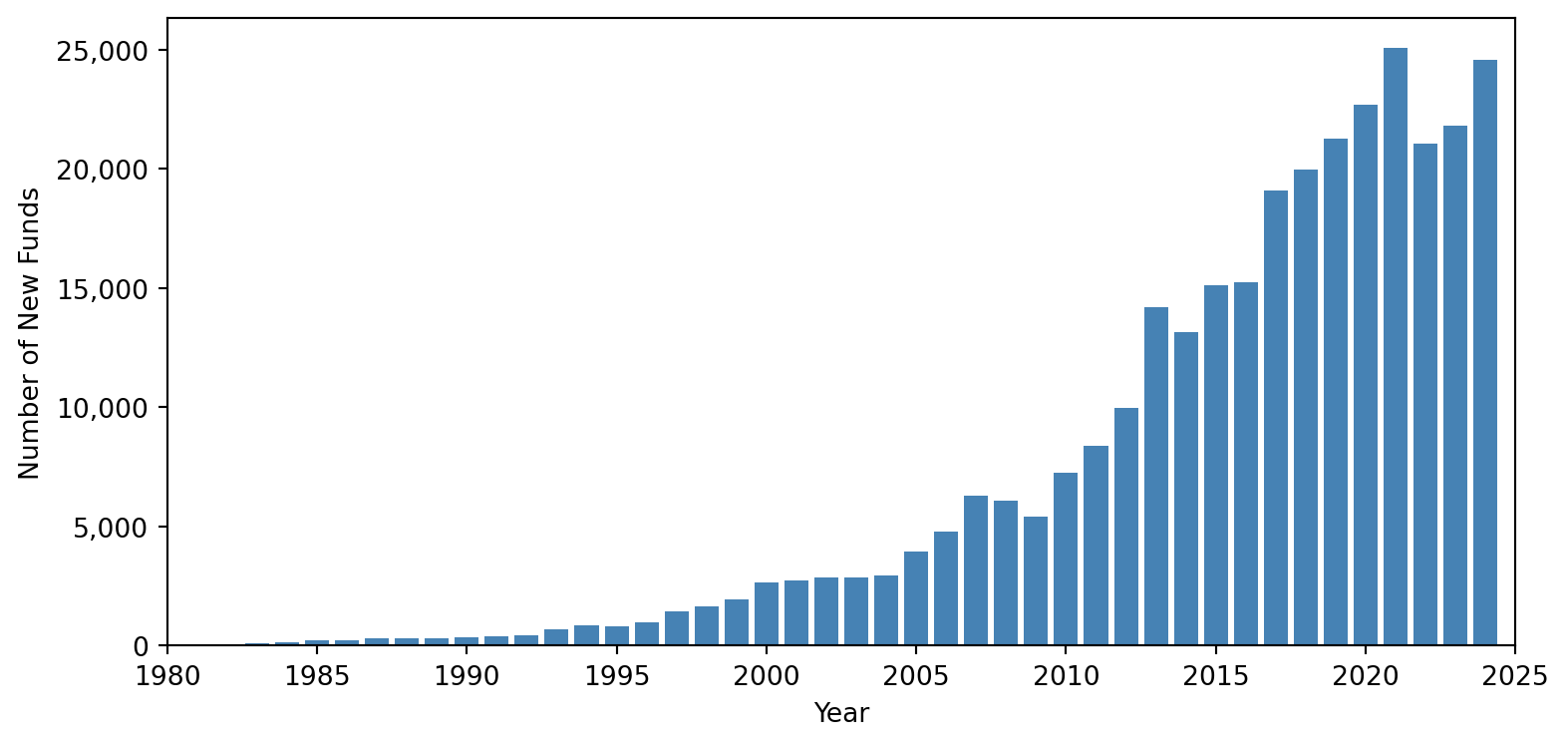

Also, I find that the number of new funds has been steadily increasing from 1980 to 2024, which means that investor interest and market participation have been expanding over this period.

Next, I am also interested in CurrenyHolding (fund currency holdings) and distribution of funds in different capital markets (e.g. FundFromArea and FundNumber). The FundSize field in the database is reported in its original currency and I have converted them to USD for comparison purpose.

| Loading ITables v2.4.4 from the internet... (need help?) |

The United States, European Union, and Britain are the leading global capital markets, dominating in both mutual fund number and magnitude of assets under management due to their mature financial systems and investor bases. In contrast, South Korea attracts no foreign mutual funds, likely due to regulatory or market barriers, while Japan remains more open. Among developing markets, China draws the most foreign investment, whereas India, despite its market size, sees no foreign mutual fund participation.

To clarify, Table I indicates that there are 29,764 funds registered in South Korea. Table II further reveals that 29,007 of these funds primarily hold assets in Korean Won, while the rest are denominated in other currencies.

III. Analysis

Morningstar provides granular holdings data for 300,170 mutual funds, covering 164 asset types such as equities, bonds, loans, derivatives, property, and crypto. However, some funds lack holdings data, and the dataset suffers from missing values and inconsistent naming. Linking assets to issuers is challenging due to limited mapping tables and unreliable name matching. In other words, It is time-consuming to clean the data and match them with Crsp and Compustat. (I will elaborate process of cleaning data in the future.)